- First Name

- Chris

- Joined

- May 2, 2021

- Threads

- 8

- Messages

- 172

- Reaction score

- 296

- Location

- Richmond, CA

- Vehicle(s)

- 2022 Badlands, '21 Badlands (RIP), '02 Ranger Edge

- Thread starter

- #1

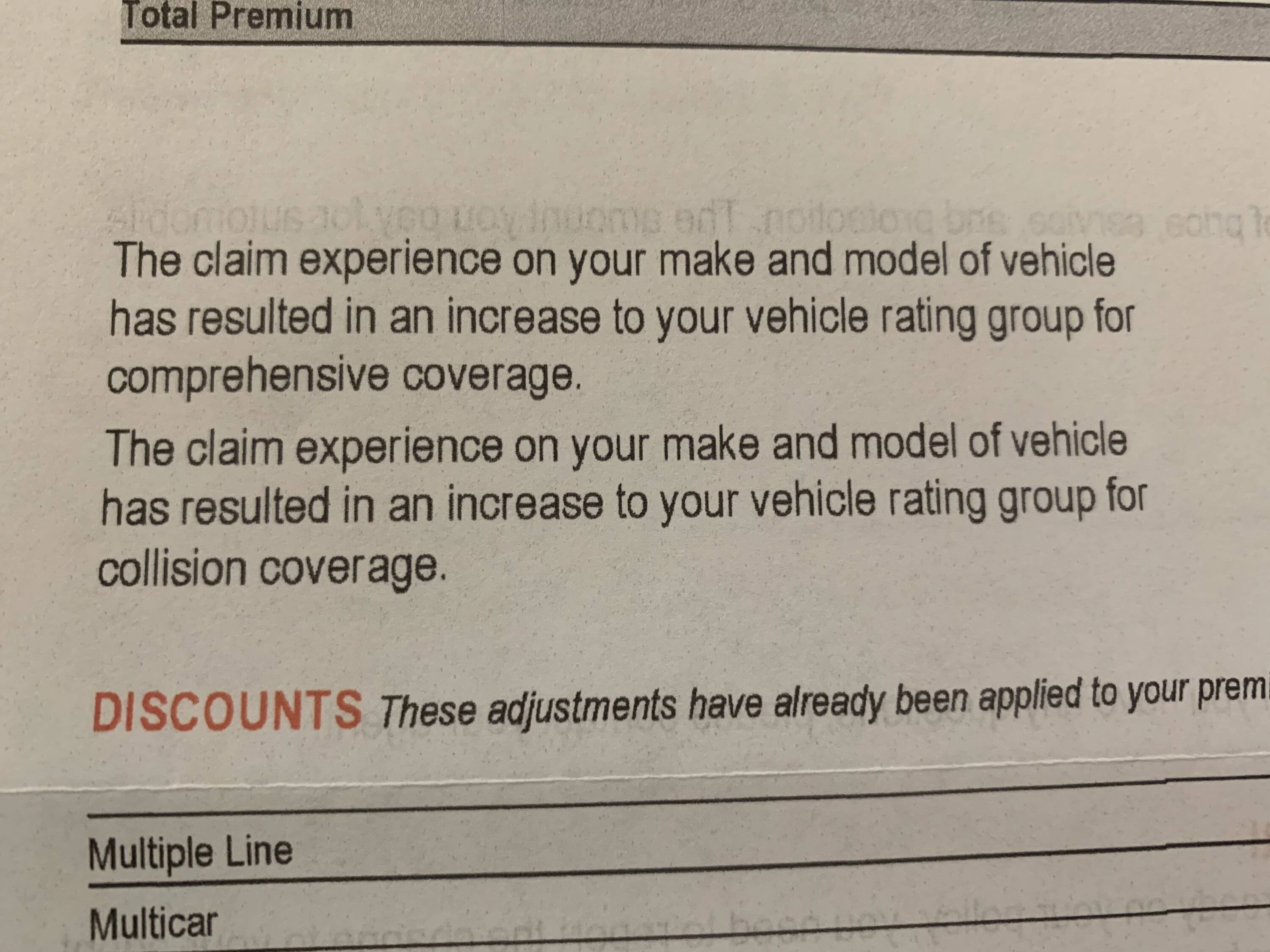

My BS is almost six months old (officially lasted longer than my wrecked 2021, yay), and I got a policy renewal notice from State Farm with this note about a rate increase:

I did the math and it seems to be about a $46 a year increase, so it’s relatively small, but it does intrigue me.

So are people with Bronco Sports getting into more collisions? The wreck that totaled my BS was the fault of an idiot driving like a fool and causing a four-car freeway crash; I was driving like a little old lady because my car was less than five months old and I was being super cautious (plus I’d broken my ankle two months prior).

I did the math and it seems to be about a $46 a year increase, so it’s relatively small, but it does intrigue me.

So are people with Bronco Sports getting into more collisions? The wreck that totaled my BS was the fault of an idiot driving like a fool and causing a four-car freeway crash; I was driving like a little old lady because my car was less than five months old and I was being super cautious (plus I’d broken my ankle two months prior).

Sponsored