- Thread starter

- #1

How excited/terrified are you?

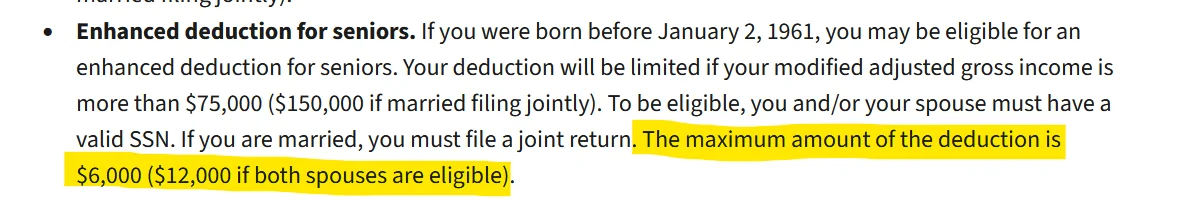

Filed my taxes this morning, earliest I’ve ever managed. Would’ve gotten it done a week ago, but Social Security doesn’t allow for download of 1099’s until February 1st each year. Hell, even DFAS makes them available in December.

Pretty good refund this year, even better next year. I don’t want to change withholding until SWSBO’s SS checks have been coming in for a full year, and she won’t start collecting until June.

For the time being I guess I’ll still use the vacation/home improvement fund excuse.

Filed my taxes this morning, earliest I’ve ever managed. Would’ve gotten it done a week ago, but Social Security doesn’t allow for download of 1099’s until February 1st each year. Hell, even DFAS makes them available in December.

Pretty good refund this year, even better next year. I don’t want to change withholding until SWSBO’s SS checks have been coming in for a full year, and she won’t start collecting until June.

For the time being I guess I’ll still use the vacation/home improvement fund excuse.

Sponsored